Bitcoin: A new paradigm in monetary economics is born!

On 10/31/2008, under the pseudonym of Satoshi Nakamoto, a paper entitled "Bitcoin: A p2p Electronic Cash System" was published in a cryptographers' mailing list. Today, after 13 years, we can affirm that this event marked the emergence of a new monetary paradigm, the beginnings of which we are currently experiencing.

On 10/31/2008, under the pseudonym of Satoshi Nakamoto, a paper entitled "Bitcoin: A p2p Electronic Cash System" was published in a cryptographers' mailing list. Today, after 13 years, we can affirm that this event marked the emergence of a new monetary paradigm, the beginnings of which we are currently experiencing.

Now, what is it that leads us to say that this invention marked a new link in the development of monetary technology? This is the question we will try to answer in this paper.

Let us begin.

A brief history of money

While Bitcoin is an innovation of the digital age, the problems it seeks to solve, mainly to offer a form of money that is under the exclusive control of its owner and that allows it to maintain its value in the long term, are as old as society itself.

If we go back to primitive human tribes, we can observe that many of them exchanged products by means of barter. However, this system was often inefficient, since a double coincidence of needs was required for the transactions to take place. This would worsen with the advent of agriculture and the emergence of greater specialization in work within human societies. Thus arose the need for elements that could serve as a means of exchange in transactions, thus giving birth to what we know as money.

Although at first this means of exchange was represented by certain "commodities" (salt, cattle, etc.), with the passage of time certain metals (gold, silver, bronze) began to adopt this function, given their scarce supply, durability and physical properties, which resulted in greater stability over time.

Later, with the improvement of metallurgy, these metals were molded into identifiable units, the coins, thus standardizing their value and facilitating a more agile trade since it was no longer necessary to weigh and verify these metals in each transaction.

However, as time went by, this system also began to experience certain weaknesses due to the difficulty of transporting the coins over long distances. Likewise, counterfeiters and even governments emerged that reduced the percentage of metals in these coins, compromising their purity and reducing their value in what was presented as a true transfer of value to these dishonest actors.

Between the 11th and 13th centuries, the first banknotes began to appear, similar to commercial bills of exchange. This was intended to solve the problem of transporting large quantities of precious metals for international trade.

Later, with the development of the banking system and an improvement in communication systems, the first banknotes issued by banks appeared. These bills were a form of representative money that could be converted into gold or silver on application to the bank. Gradually, such banknotes issued by private commercial banks were replaced by banknotes authorized and controlled by national governments.

Such a system allowed gold-backed transactions on a scale never seen before and ushered in what is known as the "gold standard". However, its Achilles heel was the centralization it entailed. By centralizing all gold in the vaults of banks (and later central banks), it was possible for these institutions and governments to increase the money supply beyond the reserves they held, devaluing the currency and transferring part of its value from the rightful owners to the banks and governments.

This tendency for governments to issue without backing intensified during the 20th century. At the end of World War II, the Bretton Woods Agreement gave birth to the dollar standard. The dollar thus became the reference currency for the remaining currencies, while each ounce of gold was fixed at US$ 35. The Central Banks could exchange gold for dollars and vice versa through the Federal Reserve.

By the beginning of the 1970s, in a context of world inflation, with an abundance of US dollars, many countries massively converted dollars into gold, which led to a significant emptying of the Federal Reserve's gold holdings. This precipitated that in 1971 President Richard Nixon decreed the end of the Bretton Woods agreement. There would no longer be a metal backing the issuance of dollars, but rather they would be backed by the authority that issued them. Thus, fiat currencies were born, backed solely by confidence in the central banks of the States.

The main problem with fiat currencies is the absence of physical, economic or natural restrictions limiting the amount of money the government can produce. The ever-increasing supply means a continuous devaluation of the currency, expropriating the wealth of the holders to benefit those who print the currency and those who receive it first. As Satoshi Nakamoto put it:

"The root of the problem with conventional currency is all the trust that is required to make it work. The central bank must be trusted not to devalue the currency, but the history of fiat currencies is littered with violations of that trust." - Satoshi Nakamoto's post of 02/11/2009

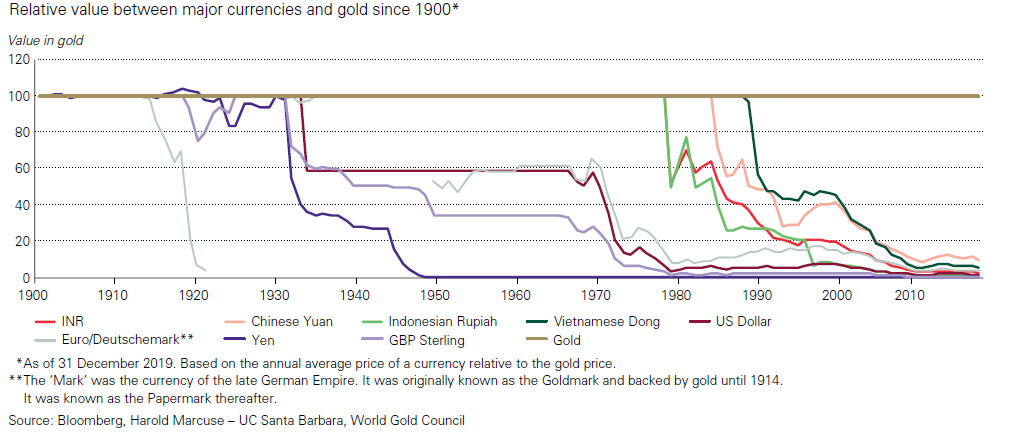

We can verify Satoshi's statement by looking at the relative loss in value of the major fiat currencies relative to gold since 1900, shown in the chart below:

Government control of money has turned money from a reward for producing value to a reward for obedience to government officials. Thus, it is impractical for anyone to develop wealth with government money without government acquiescence, since the government can artificially inflate the currency to devalue the wealth of its holders and/or reward its most loyal subjects. Likewise, the government can impose abusive taxes and regulations, as well as punish those who avoid them, by confiscating taxpayers' money through the banking and financial institutions it ultimately controls.

Bitcoin: a decentralized solution

In the image below, we can see graphically the whole process described in the previous sections, and we see Bitcoin as the latest step in the evolution of this technological instrument we call "money":

So, what is this digital money ecosystem and how does it solve the problems associated with fiat currencies?

While I began the text by stating 2008 as the birth date of Bitcoin, Bitcoin represents the culmination of decades of research in the fields of cryptography and distributed systems. It was the unique combination of the following four technologies that was truly revolutionary:

- A decentralized peer-to-peer network (the bitcoin protocol).

- A decentralized public ledger (the blockchain)

- A set of rules for the validation of transactions and the issuance of new coins (consensus rules)

- A mechanism for globally reaching consensus on the valid blockchain (proof-of-work algorithm - PoW).

In this way, Bitcoin gives rise to what Andreas Antonopoulos calls: "the internet of money, a network that allows to spread value and secure ownership of digital assets through distributed computing".

Among its characteristics and core values we can highlight:

Decentralization

One of the objectives stated in the Bitcoin whitepaper is to "create an electronic money system that does not depend on a central authority for the issuance of currency, settlement or validation of transactions".

To achieve this, Bitcoin uses a distributed computing system that makes it possible to reach a consensus on the status of transactions in a "global election" that takes place every 10 minutes or so. This system, called the Proof of Work (PoW) algorithm, solves the double-spending problem, and allows the network to transact without the need for a central authority.

As it is decentralized, it has no owner, so no authority can decide on the fate of the network in a particular way. Any point of attack on a central entity is diluted, because there is no central entity as such. Everyone can participate in the network on equal terms. Bitcoin belongs to everyone. Bitcoin is everyone.

Likewise, from a political and economic point of view, this invention provides individuals with a clear technical solution to escape the financial influence of the governments under which they live, which has been increasing since the birth of the Modern States, and which will reach its maximum expression with the creation of fiat money.

Security and control

A centralized model such as a traditional bank or payment network depends on access controls and monitoring of the actors. In contrast, a decentralized system such as Bitcoin relies on users' control of their digital signatures (using a public key/private key signature system), as well as validation of transactions by miners.

A signed transaction authorizes only a specific amount of bitcoins to be sent to a specific recipient and cannot be modified. It does not reveal any identity of the parties and the data contained therein cannot be used to authorize additional payments, unlike what happens, for example, with credit cards, where sensitive data such as the name and number of the card, which could be used for subsequent transactions, are exposed for each purchase.

Control and responsibility are thus returned to the users. No one other than the user who is aware of the private key can spend the user's bitcoins, just as no third party can modify a transaction, nor backtrack it once it has been mined and added to the blockchain.

Privacy

The rise of data analytics in recent years, coupled with various "know-your-customer" regulations, meant that traditional financial system players as well as tech giants (Google, Facebook, etc.) are now keeping a close eye on all their customers and their actions.

Unlike these entities, Bitcoin offers an environment where privacy is respected and transactions are pseudonymous.

Global

Bitcoin knows no borders. Being a decentralized network, it is composed of nodes that can be literally in any corner of the globe.

One characteristic of money is its portability, i.e., it must be easy to transport and use. Since Bitcoin is completely digital, it is enough to remember the private key of an address to be able to transact regardless of the user's physical location. Likewise, the destination is not a limitation either, since it has no jurisdiction in this regard.

Thus, in an increasingly globalized world, it allows transactions to be generated efficiently. Just think of the experience of making a wire transfer abroad with the traditional banking system, which involves paperwork, restrictions and delays in terms (a SWIFT takes between 1 and 3 days), with the ease of a bitcoin transfer that can be made in 10 minutes without any impediment.

Transparency, neutrality and predictability

Unlike the traditional financial system, which relies on third parties to manage information and transactions, each transaction within the Bitcoin blockchain is public and can be verified by any user who wishes to do so.

Bitcoin is also decentralized, so no one can ever have total control over the network. It is virtually impossible to reverse or modify a transaction. This is due to the structure of the blockchain, where each block is "chained" to the previous one. Changing a transaction within a block would mean altering all the previous blocks and propagating this information through more than 51% of the nodes in the network. The computational power required and the consequent economic cost far exceeds any benefit that would be expected.

Likewise, no one can be denied participation in it. All prejudices of nationality, wealth, religion, etc., are thus broken down. Everyone can participate in the network under the same conditions.

Finally, unlike all types of currency that have gone through the history of mankind, Bitcoin has a finite and scarce supply. Embedded in the code is the rate of issuance of new bitcoins, which is effected in each new block, in a transaction called "coinbase" that is given as a reward to the user who mines that block. Initially set at 50 BTC per block, it is reduced by half every 210,000 blocks, a process known as halving, until reaching the maximum offer of 21,000,000 BTC.

This aligns the incentives for miners, while establishing for the first time in history a monetary system with truly finite issuance, with all that this implies for the store of value that every currency must have.

Speed

Transactions within the Bitcoin network are destined to be resolved in a matter of minutes, regardless of the location of the parties involved in the transaction.

Likewise, several technologies have been generated on the main layer, which make it possible to solve certain scalability issues for mass use. By way of example, we can mention the development of the Lightning Network (LN), which allows instant operations to be carried out with almost zero commissions.

Freedom

Today, freedom is an invaluable asset. We cannot say that we are free from the controls and surveillance of government authorities if we are at the mercy of new regulations and limitations to use our money freely.

Bitcoin is not affected by these regulations or restrictive monetary policies issued by states. Anyone who owns Bitcoin achieves a degree of economic freedom that was not possible before its invention. Bitcoin holders can send large amounts of value around the globe without having to ask anyone's permission or involve third parties to validate the transaction.

Conclusion

We have seen how Bitcoin, despite its young age, has become a real option capable of disputing the reign of the fiat currency system imposed by governments, and thus become the new monetary paradigm. This, without depending on third parties, in a decentralized, secure, free and transparent manner.

We can say then, that we are facing a new technology that allows keeping money under the exclusive control of its owner (there is no government or third parties that can act on such asset) and that allows maintaining its value in the long term (as it has a finite supply as opposed to the uncontrolled issuance that characterizes fiat currencies).

In the words of Nassim Nicholas Taleb: "[Bitcoin] is an insurance policy that will remind governments that the last object the establishment could control, currency, is no longer their monopoly. It gives us, the crowd, an insurance policy against an Orwellian future."